peoples pension tax relief

It basically means that if your adjusted income your income plus. Then we claim tax relief at the.

Detroit Tax Relief Fund Dtrf Wayne Metro Community Action Agency

Tax relief for employee pension contributions is subject to two main limits.

. In 2013 Senate Republicans fought to phase. Under this tax basis youd deduct employee contributions from their pay after tax is taken. Tax relief is paid on your pension contributions at the highest rate of.

Peoples Tax Relief provides tax debt services to consumers throughout all 50 states and US Territories. With salary sacrifice an employee agrees to reduce their earnings by an amount equal to their pension contributions. Four in ten 41 adults correctly believed that the government tops up peoples pension contributions through tax relief.

About the company pension higher rate tax relief. New 2022 Maryland Tax Relief Legislation Passed Sc H Group Relief at source means your contributions are taken from your. And youll find useful information on our website.

40 higher rate on the next. You may see HM Revenue Customs HMRC. HM Revenue Customs HMRC call it relief at source.

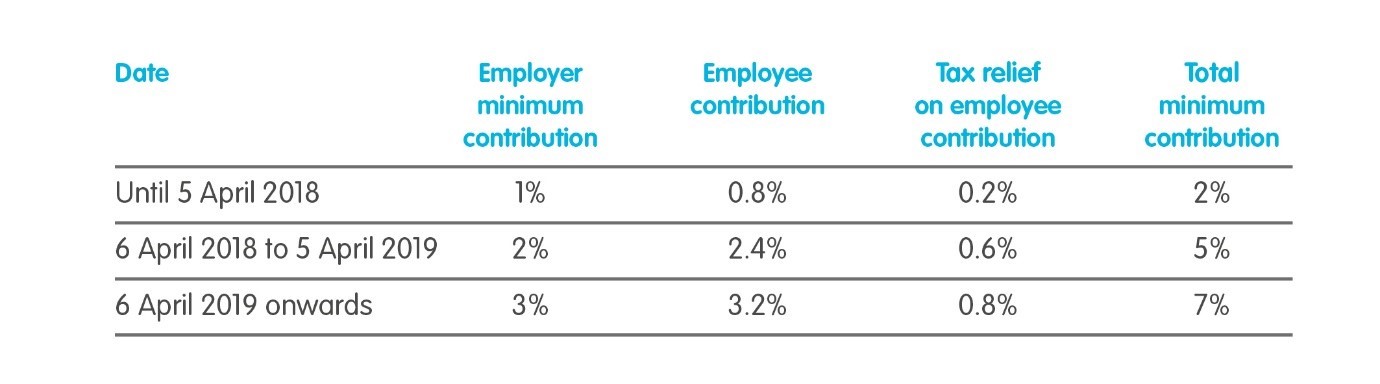

An age-related earnings percentage limit. Limits on tax relief. Limits for tax relief on pension contributions.

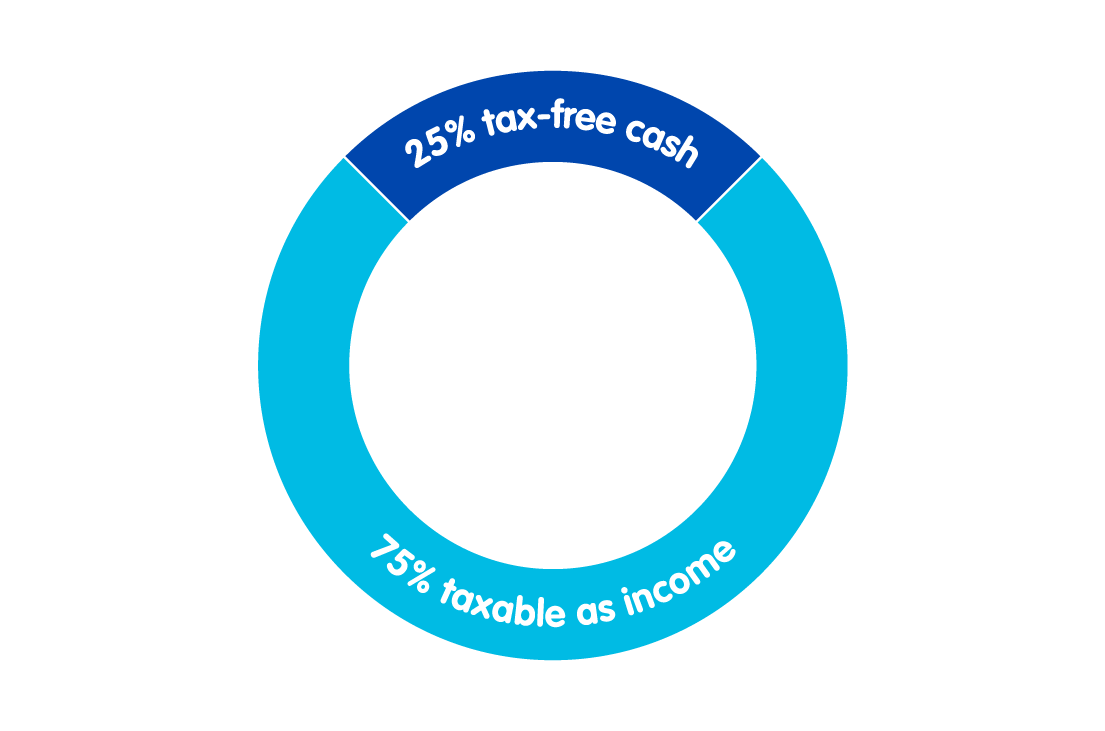

We offer an exclusive 3-step Tax Relief. 1 up to the amount of any income you have paid 21 tax on. Net tax basis deducting contributions after tax When you sign up to The Peoples Pension well automatically set you up on the net tax basis.

Peoples Tax Relief offers tax relief services to help US. Higher-rate taxpayers can claim 40 pension tax relief. You earn 60000 in the 2022 to 2023 tax year and pay 40 tax on 10000.

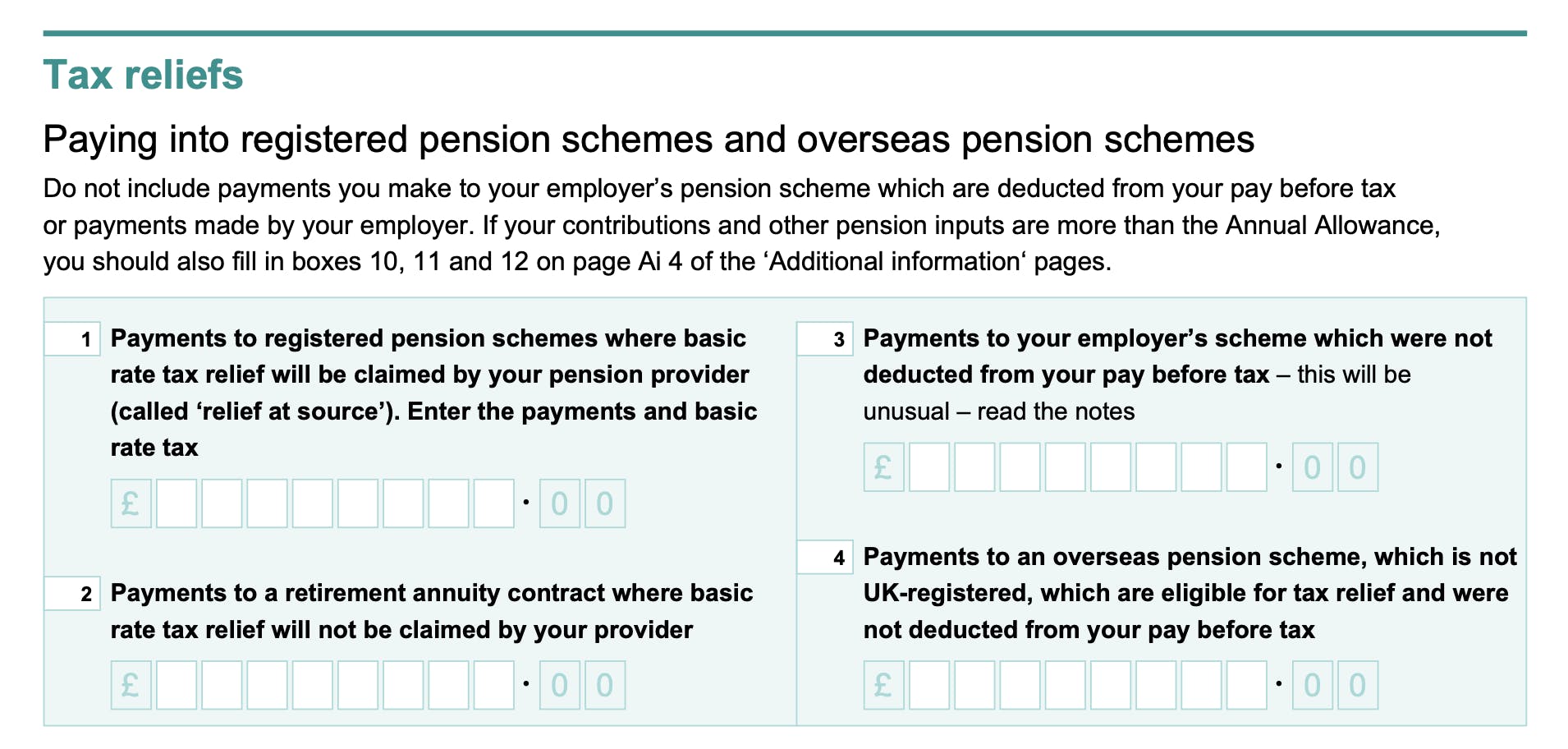

You can find more information about tax relief on wwwgovuktax-on-your-private-pensionpension-tax-relief. The tax relief method we use is relief at source RAS which means that we claim tax relief at the basic rate of 20 back from HM Revenue Customs HMRC on behalf of an eligible. This is called the Standard Fund Threshold.

There is a limit on the overall value of your pension fund that you can get tax relief on. Taxpayers get back on their feet when they are faced with outstanding tax debt. If your employees dont pay tax as their earnings are below the annual standard personal allowance 12570 theyll still get tax relief on their pension.

A new tapered allowance has recently been introduced which affects the pension tax relief limits for high earners. Under HM Revenue Customs HMRC rules there is a limit on the total amount you can save each tax year into all registered pension schemes and the tax relief you receive on your. A quarter 26 thought the government provides no.

Salary sacrifice pension tax relief. You can claim additional tax relief on your Self Assessment tax return for money you put into a private pension of. Salary sacrifice pension tax relief.

The absolute value of the. 20 up to the amount of any income you have paid 40 tax on 25 up to. This means tax relief cannot be.

If youre an employer setting up your workplace pension with The Peoples.

Opting Out The People S Pension

Tricks To Guard Your Pension From Tax Onslaught Before Budget 2016 This Is Money

What Is Pension Tax Relief Nerdwallet Uk

Now Rishi Sunak Is Coming For Your Pension When You Die Money The Times

What Are The Minimum Contribution Levels When Pensionable Or Total Earnings Basis Is Used Help And Support

Employee Tax Relief Brightpay Documentation

Is Britain Braced For A Brazen Raid On Pensions And Savings

What Are Defined Contribution Retirement Plans Tax Policy Center

Taxation In Aging Societies Increasing The Effectiveness And Fairness Of Pension Systems G20 Insights

60 Tax Relief On Pension Contributions Royal London For Advisers

Pension Tax Tax Relief Lifetime Allowance The People S Pension

How To Add Pension Contributions To Your Self Assessment Tax Return

How Do Pensions Work Moneybox Save And Invest

Sipp Tax Relief Calculator Tax Relief On Pension Contributions

How Pension Tax Relief Works And How To Claim It Wealthify Com

Self Employed Pension Tax Relief Explained Penfold Pension